Smart Tax Planning for Fix-and-Flip Investors in 2026

Topics: Property Investment Strategies, Investment Property Strategies, real estate investing, Rental Property Tips, Fix-and-Flip tips, Tax Tips

Where Profit Meets Purpose: Making Home Matter Through Real Estate Investing

Topics: Single family rentals, House Flipping, real estate investing, Housing Market Trends

The 2026 Real Estate Investor Reset Guide: Habits, Systems, and Mindsets That Make (or Break) Your Year

Topics: Property Investment Strategies, Investment Property Strategies, real estate investing, Rental Property Tips, Fix-and-Flip tips, New Year Planning

Late-Year Rate Trends: What Real Estate Investors Should Know as 2025 Comes to a Close

But before assuming that a softening in rates means smoother sailing ahead, it’s worth stepping back to unpack what this trend really means and where private lending continues to offer long-standing advantages.

Topics: House Flipping Market Insights, Property Investment Strategies, Single family rentals, Housing Market Trends

How Strategic Lending Partnerships Create More Opportunity for Real Estate Investors

If you are someone who regularly works with real estate investors, partnering with the right lender can elevate the value you bring to your clients. Let’s break down what this looks like.

Topics: Insider, Property Investment Strategies, Investment Property Strategies, House Flipping, Networking

Unlocking a Powerful Tax Tool for Real Estate Investors: 100% Bonus Depreciation Is Back

At Residential Capital Partners, we help residential fix-and-flip and rental investors move quickly on opportunities that make sense. This renewed tax incentive adds another lever to boost returns, improve cash flow, and reinvest faster. Here’s what you need to know.

Topics: Rental Property Investment, Property Investment Strategies, Single family rentals, House Flipping, Housing Market Trends, Budgeting Tips, Rental Property Tips

Fall Market Shifts: What Real Estate Investors Should Watch Before Year-End

Here are some of the seasonal shifts to keep in mind as you move through the final quarter of the year:

Topics: Rental Property Investment, House Flipping Market Insights, Single family rentals, House Flipping, Housing Market Trends, Fix-and-Flip tips

The Investor’s Guide to Partnering with Contractors

We've outlined some simple strategies to turn contractor relationships into a competitive advantage on every flip!

Topics: How to Fix & Flip, Single family rentals, House Flipping, real estate investing, Networking, Contractors

What the Fed’s September 2025 Rate Cut Means for Real Estate Investors

This recent cut has sparked a lot of conversation in the real estate world, and for good reason. Lower rates have ripple effects across the market, from mortgage affordability to investor financing. But what does this really mean for you as a fix-and-flip or rental property investor? And where does private lending fit into the picture? Let’s break it down.

Topics: House Flipping Market Insights, Property Investment Strategies, real estate investing, Housing Market Trends

How Millennials and Gen Z Are Creating New Opportunities for Real Estate Investors

Topics: House Flipping Market Insights, Property Investment Strategies, Single family rentals, Housing Market Trends

The Coffee Shop Conversations That Spark Real Estate Investing Wins

Topics: Single family rentals, House Flipping, Rental Property Tips, Fix-and-Flip tips, Networking

The Real Estate Investor’s Guide to Seasonal Property Maintenance

Here’s a quick guide we've put together to emphasize some of the most important seasonal maintenance tasks you should consider as a fix and flip or long-term rental property investor.

Topics: Rental Property Investment, Single family rentals, House Flipping, Rental Property Tips, Fix-and-Flip tips

Tenant Red Flags: What Experienced Real Estate Investors Look For Before Signing a Lease

Here are some key red flags to keep in mind before signing that lease and turning over your property.

Topics: Rental Property Investment, Single family rentals, House Flipping

5 Essential Questions to Ask Your Private Lender

Topics: How to Fix & Flip, House Flipping Market Insights, Property Investment Strategies, Single family rentals, House Flipping

Sell Your Fix and Flip Faster: The Power of Staging and Photography

Here’s why staging and photography should be part of your flipping playbook—and how to use them to your advantage.

Topics: How to Fix & Flip, House Flipping Market Insights, Property Investment Strategies, House Flipping

Smart Renovations to Maximize ROI in 2025

Topics: How to Fix & Flip, House Flipping Market Insights, Property Investment Strategies, Single family rentals, House Flipping

Building a Rental Empire: Strategies for Scaling Your Rental Property Portfolio

When you’ve successfully launched your first rental investment—maybe you've renovated the place and stayed within budget, tenants are secured, and you have consistent cash flow coming in—it can feel like you’ve cracked the code. Passive income, long-term equity growth, and tax advantages are just a few of the reasons smart investors look to investing in rental properties in the first place. But the real momentum starts when you go from one or two properties to building a full-scale portfolio.

So, how do you scale strategically and what should you keep in mind as you grow? We've outlined a few smart strategies to help you build your rental empire, one property at a time.

Topics: Fix-and-Flip Financing Tips, House Flipping Market Insights, Single family rentals

Budgeting Beyond the Purchase Price—Understanding the Less Obvious Costs of Your Fix and Flip

If you're looking to maximize your returns, here’s a comprehensive look at the real cost of a fix and flip, with key expenses you need to account for before signing on the dotted line.

Topics: Fix-and-Flip Financing Tips, Property Investment Strategies, Budgeting Tips

Bridge Rental Loans vs. Long-Term Rental Loans: Understanding the Differences

Topics: Property Investment Strategies, Single family rentals, Loans

Turning High Rates into High Opportunities: Smart Moves for Real Estate Investors

If the Federal Reserve’s rate hikes have your stomach in knots, you’re not alone. America is grappling with an affordable housing crisis. Demand remains high, but rising interest rates have created a gridlock in supply. It’s tempting to hunker down and wait for the storm to pass during such uncertain times. While this defensive approach is common, history teaches us that challenges often mask opportunities.

Topics: Fix-and-Flip Financing Tips, House Flipping Market Insights

Advice for Real Estate Investors Heading Into 2025

As the new year approaches, the real estate market continues to evolve, presenting new challenges and opportunities for investors. Whether you're focusing on fix-and-flip projects or building a portfolio of long-term rental properties, staying informed and agile is key. Here are some practical tips to help you thrive in the year ahead.

Topics: Fix-and-Flip Financing Tips, House Flipping Market Insights

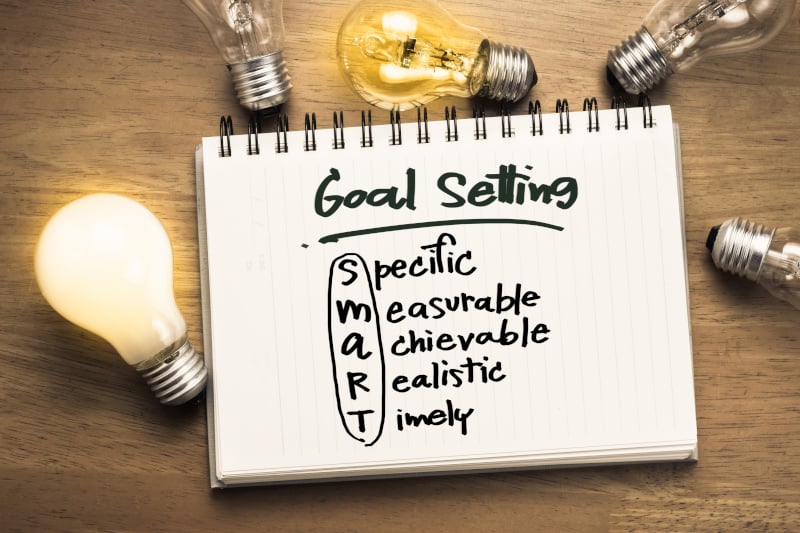

Goal Setting Strategies to Invest Smarter in the New Year

As the new year approaches, it's the perfect time to set fresh goals and shape your investment strategies for success in 2025. Real estate investment properties offer exceptional opportunities to build wealth, but maximizing returns requires a thoughtful plan. Here are some key steps to help guide your investment property strategies and make 2025 your most profitable year yet.

Topics: Fix-and-Flip Financing Tips, House Flipping Market Insights, Single family rentals

4 Key Considerations for Investing in Rental Property

Rental properties continue to be a popular investment option, offering the potential for steady passive income and long-term financial security. However, success in this area requires careful planning, knowledge of the market, and a clear investment strategy. Whether you’re a seasoned investor or new to real estate, we've outlined four of the most important things to consider when investing in rental properties today.

Topics: Fix-and-Flip Financing Tips, Rental Property Investment, Single family rentals

Why Winter May Be the Best Time to Finance Your Fix-And-Flip

As you trade those shorts and tanks for sweaters and fireside blankets, try not to get too cozy—motivated real estate investors know that this chilly season can offer a hotbed of opportunities. From less competition to potential tax deferment, we're outlining some compelling reasons why winter might just be the perfect time to get your next project underway.

Topics: Fix-and-Flip Financing Tips, House Flipping Market Insights, Single family rentals

Why Down Payments in Private Lending Are Bad for Business

Down payments are a standard part of private lending. Real estate investors often accept them as a necessary step to finance their rehab projects, focusing more on securing the lowest interest rates. However, the down payment you make significantly impacts your business, leaving you cash poor in a cash-intensive industry.

Topics: Fix-and-Flip Financing Tips, real estate investing, Private Money Lenders

DSCR Loans vs. Mortgage Loans: Why Choose One Over the Other?

In the real estate investment world, choosing the right financing option is crucial for success. Two popular options are Debt Service Coverage Ratio (DSCR) loans and traditional bank loans. Here, we’ll explore the differences, advantages, and disadvantages of each, and why you might choose one over the other.

Topics: Rental Property Investment, Property Investment Strategies, real estate investing, Loans

Hot Suburban Markets for Rental Properties in 2024

As we move further into 2024, the real estate market continues to evolve, with suburban areas emerging as prime spots for rental property investments. The pandemic’s lasting impact on work-life dynamics has driven many families and professionals to seek more space and a better quality of life outside urban centers. For real estate investors, this shift presents a golden opportunity. Let’s explore some of the hottest suburban markets for rental properties in 2024.

Topics: Rental Property Investment, House Flipping Market Insights, Property Investment Strategies, Single family rentals, real estate investing

Avoiding Common Pitfalls: Key Advice for Experienced Real Estate Investors

As an experienced real estate investor, you've achieved a level of success that many aspire to. With numerous deals completed and a solid track record, it’s easy to fall into the trap of complacency. However, maintaining excellence requires constant vigilance and adherence to the principles that built your success. Here are some common mistakes seasoned investors often make and how to avoid them.

Topics: Insider, Property Investment Strategies, real estate investing, Private Money Lenders

How to Avoid a Slow No from Private Lenders

CNBC’s Squawk Box recently reported that through the first eight months of 2023, the real estate investment community turned to private lenders to fund their deals 70% of the time. It’s no secret why single-family real estate investors choose private lenders over traditional banks: speed. The private lending community moves faster than traditional banks and, thanks to their business acumen and experience, is more likely to take mitigated risks during uncertain times.

That said, it is not uncommon for real estate investors to hear “no” from lenders in periods of market volatility. When interest rates are high, lenders—especially those backed by Wall Street—are far more scrupulous of the deals coming across their desk, which can extend their time to approve or deny your loan. The longer it takes for your deal to be approved—the greater the likelihood of the deal falling through. A “no” hurts, but if received in a timely manner, still leaves you with time to find financing elsewhere. A “slow no” can be death by a thousand cuts, evaporating the time you need to find a financing solution.

What’s an investor to do? Here are a few practices single-family real estate investors can employ to circumvent a “slow no” from private lenders, as told from three of Residential Capital Partners’ account executives, James Loffredo, Kyle Dreyer, and Hunter McLean.

Topics: Fix-and-Flip Financing Tips, Fix-and-Flip Lenders, real estate investing, Private Money Lenders

The first rule of investing: don’t lose money. The second rule: don’t forget the first. (Thank you, Warren Buffet.)

Residential Capital Partners has been in the investment-making business for over 25 years. Along with my three partners, we’ve adhered strongly to rules one and two, as well as generating several other investment principles to live by, gleaned by our own experiences—namely in respect to the importance of due diligence, rigorous financial analysis, and conservative exit expectations to mitigate risk and protect margin.

The following principles have shaped the structure and growth of Residential Capital Partners over the past 15 years, but they’re applicable for any investor, whether you’re wholesaling houses, rehabbing and flipping houses, or investing in single family rentals to build wealth.

Topics: Fix-and-Flip Financing Tips, Fix-and-Flip Lenders, real estate investing, Private Money Lenders

Our Story with Homevestors (interview)

In business as in life, you’re only as strong as your relationships. Which is why we’re so proud of our relationships with HomeVestors franchisees over the last 15 years. Our relationship spans the global financial crisis of 2008, the global pandemic of 2020 and the rising interest rate environment of 2023. Through it all, we have been honored to help the franchisees at HomeVestors succeed in good times and bad.

Henry Ford said it best: “Coming together is a beginning; keeping together is progress; working together is success.”

To tell our story of success with HomeVestors, we gathered Residential Capital Partners’ leadership and a couple of HomeVestors’ top performing franchisees for an interview that’s been a long time coming.

How did HomeVestors and Residential Capital Partners first join forces?

Paul: Everyone in finance has a story from 2008. For Residential Capital Partners, it was the beginning of our relationship with HomeVestors. The global financial crisis created a void of credit in the single-family rehab and rental marketplace and HomeVestors needed a balance sheet lender to supply financing for its franchisees. Wall Street shut down and traditional banks sat on their hands, but we decided to lean in and provide capital to the HomeVestor franchisee community because we were so impressed with their training, work ethic and values. Since that time, we’ve closed 3,153 loans for HomeVestors franchisees.

Topics: Fix-and-Flip Financing Tips, Fix-and-Flip Lenders, Property Investment Strategies, real estate investing

What the AA+ Fitch Ratings Downgrade Means For Investors

This month, Fitch Ratings downgraded the United States’ long term ratings from AAA to AA+, citing growing government debt and repeated fights in congress over raising the debt ceiling as major factors in their determination. You might be wondering: is this bad news for single-family real estate investors?

Hold that thought.

Topics: House Flipping Market Insights, Property Investment Strategies, real estate investing, Housing Market Trends

Signs Your Private Lender Is Pulling A Bait-and-Switch

Single-family real estate investors are usually good with numbers – they have to be in order to achieve success in the real estate investment business. The math equation going into every real estate investment is paramount to profitability – which makes it easy to get fixated on finding the lowest possible interest rate (especially when interest rates are high), and potentially overlook the signs of a wily lender attempting a bait-and-switch.

Suspicious you’re not getting the deal that got you to walk in the door? Here are the telltale signs your private lender does not have your best interest in mind, and how to avoid the bait-and-switch trap:

Topics: Fix-and-Flip Financing Tips, Fix-and-Flip Lenders, real estate investing, Private Money Lenders

Networking is an essential skill for success in any industry. For house flippers, it can open doors to new opportunities, partnerships, and perspectives that can help you scale your business. (Even when interest rates are high!) Business cards and social media groups are a good start – but the following underused strategies will give you an edge over the competition.

Topics: Fix-and-Flip Financing Tips, Fix-and-Flip Lenders, Property Investment Strategies, real estate investing

Questions to ask when choosing a rental property loan

Demand for affordable housing remains high, which is good news for single-family real estate investors across America. As the single-family rental (SFR) industry continues to mature and become more institutional across the board, many investors are opting to keep their flips as rental properties.

The steps to fix-and-flip and fix-and-hold are similar, but there are important things to consider as you build a rental portfolio. You’ll want to answer some strategic questions on your journey to building long-term wealth.

Should I Choose a Fixed or Adjustable Rate?

After nine consecutive rate hikes by the Federal Reserve since March 2022 and a Fed Funds rate over 5%, every investor in America is acutely aware of interest rates and the impact they can have on their investment. For the SFR investor looking for the right financing solution for a rental property, there are two options: a mid-term or long-term approach.

The mid-term solution comes in the form of a 5, 7, or 10-year interest-only, adjustable-rate mortgage (ARM). The benefits of a mid-term solution are two-fold: 1.) You only pay interest on the principal balance of the loan, which means cashflow is higher than that of a fully amortizing loan, and 2.) You have a window of time to assess long-term interest rates and plan for the day when you ultimately lock in a long-term 15 or 30-year financing solution. The risk of an ARM is that long-term interest rates move higher than your existing interest rate during the 5, 7 or 10-year window and you get stuck in a negative leverage situation.

The long-term solution comes in the form of a 15 or 30-year fully amortizing, fixed rate mortgage. The benefits of the long-term solution are also two-fold: 1.) You have certainty of what your mortgage payment will be over the long-term, regardless of what happens in the interest rate market, and 2.) At the end of the financing period, the asset will be free and clear of all debt while still providing a steady stream of cashflow. The downside of a long-term solution is that these mortgages typically come with hefty pre-payment penalties over the first five years of the mortgage period, which makes it more costly if you want to refinance the asset as/if long-term interest rates move down during that five-year period.

Topics: Fix-and-Flip Financing Tips, Fix-and-Flip Lenders, Property Investment Strategies, real estate investing

Smart moves when interest rates are high

Is your stomach turning every time the Fed raises their rates? You’re not alone. America is facing an affordable housing crisis; demand for affordable housing is high, but the high interest rate environment created by the Fed is producing gridlock when it comes to supply. You may be thinking it’s a good time to circle the wagons and wait out the storm. A defensive stance like so is not uncommon in times of economic uncertainty. But if history has a way of repeating itself (and it does), then now is the time to hunt for opportunity.

Topics: Rental Property Investment, House Flipping Market Insights, Investment Property Strategies, real estate investing

Beware the down (down payment, that is!)

Down payments are typical in private lending. Real estate investors usually accept down payments as a necessary part of financing their rehab, focusing instead on finding the lowest rate. But your down payment has a huge impact on your business. Down payments leave you cash poor in a cash intensive game.

Topics: Fix-and-Flip Financing Tips, real estate investing, Private Money Lenders

When choosing a lender, most real estate investors don’t put much thought into the origin of the lender’s source of capital—or whether they sell their notes. But choosing a balance sheet lender goes a long way in your ability to control your own destiny. In the words of Rick Morgan, Chief Investment Officer at Residential Capital Partners, “If your lender is selling your loan to Wall Street, you’re not a customer—you’re a trade.”

Topics: Property Investment Strategies, real estate investing

5 Common mistakes seasoned real estate investors make

Seasoned investors have much to be proud of—and a lot to protect. With numerous deals behind you and the balance sheet to prove it, it can be tempting to loosen the reins of your underwriting standards, lose discipline when pulling comps, or believe your success will prevent you from failure. It’s easy to forget the very fundamentals of house flipping that helped you build your business, but to be the best at anything takes continued diligence, even at the height of your game.

Over the last 15 years of serving the SFR industry, these are the most common mistakes we see made by seasoned real estate investors.

1. Falling In Love With the Deal

Sometimes investors will stretch to buy a property when a more disciplined version of themselves would have passed because the potential profit margin was just too thin. An all-in budget of 65-70% of the ARV is what brought them to the dance. But, in a seller’s market, they stretch to 75-80% of the ARV, because they fall in love with the deal. Throwing caution to the wind, they wind up eating it when any number of small mistakes erodes their flimsy margin.

Stick to your discipline of not being in the deal too high. There’s always another deal coming down the path.

2. Staying Married to a Deal

No matter how good your rehab turns out, there are market factors outside your control. Interest rates may rise, taxes and insurance may go up, inflation may push materials to levels you never expected. As a seasoned investor, you know this well. And yet, even as a market softens, the seasoned investor can hold onto a deal that he or she knows should be blown out and sold fast.

Topics: Property Investment Strategies, real estate investing

What Does the Affordable Housing Crisis Mean For Real Estate Investors?

Unless you’re investing from under a rock, you’ve probably read the headlines: affordable housing in the US is hard to find right now—both for the typical homebuyer and real estate investors. It may be tempting to sit this season out until interest rates start to come down and inventory becomes more abundant, but this is exactly the right time to maximize your profits for both fix-and-flips and single-family rentals.

To make the most of this competitive market, first learn the factors at play causing the crisis and then take stock of the opportunities at your feet: fix-and-flips, rentals, and re-fis.

What’s driving the affordable housing crisis?

The latest research on the 2023 affordable housing crisis by the National Homebuilders Association shows that 64.5M out of 123.5M total American households are able to afford a $250K home. Another 39M can afford a $150K property. The kicker is that the median price of a new single-family home is just over $425K, a price out of reach for 73% of households in the US. Add in the high cost of land, lumber, materials and manufacturing issues still rippling forward from 2020, and you begin to understand why the gap between what US households can afford and what builders can deliver is, in fact, a crisis.

Likewise, high interest rates are keeping families from moving out of their starter homes. Just five years ago, a couple could buy a starter home for $250-$300K, live in it for a year or two while they raised some money for a down payment on a bigger house, maybe worth $450K. But the fed keeps hiking up interest rates, which means mortgage lenders are hiking theirs too, which means the average US homeowner can’t afford the bigger, more expensive house. They’re staying put.

So the supply of available homes available is tightening while the demand has remained the same or increased. Inventory is tight.

Topics: Property Investment Strategies, real estate investing

What Fix-And-Flip Loan Terms Really Mean

The terms of fix-and-flip private loans can differ from lender to lender, and sometimes even deal to deal. (Sadly, the bait-and-switch method still lives on in private lending. Luckily, our terms never change.) It’s a frustrating task to try and create an apples-to-apples comparison of loan terms, which is why sometimes investors eschew much of the information about their loans to focus on a single element: interest rate. But interest rates are only one influencing factor in the overall cost and quality of your loan. It’s mission-critical to understand each line item of your terms and know exactly how much you’ll have to bring with you on closing day (ideally… as little as possible!).

To understand the big picture, let’s unpack the most common terms written into a fix-and-flip private loan, and their impact on your ROI.

Amount Funded

It’s always a good day to get a check in the mail (or transfer to your account) from your rental properties. Your net cash flow is the money you get from your tenants, minus expenses and your loan payment.

Example: You purchase a $120,000 rental home. Tenants pay you $1,200 monthly. If your expenses and loan are $1,100, your net cash flow on a monthly basis is $100. Granted, $1,200 a year isn’t a large chunk of change. It’s more like the cherry on top of the other ways rental properties make you money. Compare it to the dividend of a stock; it’s likely not your primary reason for the investment, but it sure doesn’t hurt.

Related: Learn tips and tricks on calculating ARV from Michael Blatney, Portfolio Underwriting Manager.

Topics: Fix-and-Flip Financing Tips, Fix-and-Flip Lenders, Property Investment Strategies, real estate investing

5 Ways Rental Properties Make You Money

5 WAYS RENTAL PROPERTIES MAKE YOU MONEY (AND WHY YOUR REAL ESTATE PORTFOLIO NEEDS DIVERSITY)

There are many reasons today’s most prolific real estate investors are gobbling up single family rentals: Home values are rising. The dollar is shrinking. The construction of single-family properties hasn’t caught up with demand. More American families can only afford—or find—rental properties. But rentals aren’t just a trendy way to invest into today’s market—they’re a long term money maker. And the return on investment for rentals is likely higher than you’d expect, thanks to the multiple ways this investment pays you back.

Here are the five ways you can expect a return on your investment with rental properties:

1. Mailbox Money

It’s always a good day to get a check in the mail (or transfer to your account) from your rental properties. Your net cash flow is the money you get from your tenants, minus expenses and your loan payment.

Example: You purchase a $120,000 rental home. Tenants pay you $1,200 monthly. If your expenses and loan are $1,100, your net cash flow on a monthly basis is $100. Granted, $1,200 a year isn’t a large chunk of change. It’s more like the cherry on top of the other ways rental properties make you money. Compare it to the dividend of a stock; it’s likely not your primary reason for the investment, but it sure doesn’t hurt.

Topics: Property Investment Strategies, real estate investing

What to Know About Your Private Lender

Does this scenario sound familiar?

You find an amazing investment property. Your heart is set on it. You scramble to find a private lender to close the deal—and things fall apart. Perhaps the lender denies you because it’s not one of their target markets. Or you can’t get them on the phone and another investor beats you to the punch. Or maybe—most infuriatingly—a Wall Street market turn makes your lender lose confidence and you’re left at the closing table without a closed deal wondering…. where did I go wrong?

There’s only one way to prevent every one of these scenarios: begin with the end in mind. (This is also one of Stephen Covey’s seven habits of highly effective people.) Select your lender before you look for properties, and do so with scrutiny. Choosing your lender first allows you to position your dominos so you can knock them all down, flawlessly, on closing day.

There are numerous private lenders out there. So how do you begin to compare? Ask the following questions, and the right relationship will become apparent:

Here are some things to consider when budgeting to flip vs. hold.

What is your private lender’s source of capital?

Few investors pay much mind to where their lender’s cash comes from. But you should, because many private lenders are backed by Wall Street sources of capital. So when the capital markets are all up and to the right, these private lenders close a high number of deals. But when the winds of Wall Street change—which they do from time to time—they cancel deals, alter terms or close up shop until the wind blows over leaving you, the investor, stranded.

Look for a private lender that uses their own money: a balance sheet lender. Residential Capital Partners is a balance sheet lender that controls its own destiny as well as yours through use of its own capital on each closed deal. That’s how we thrived during the 2008 housing crisis and throughout the 2020 pandemic. We approved countless deals for investors whose initial lender changed the terms of the deal at the closing table or flat out walked away from the closing table during a bear market.

Topics: Fix-and-Flip Financing Tips, Fix-and-Flip Lenders, Investment Property Strategies, Private Money Lenders

Are You Overspending on Your Rehabs?

According to the 2022 US Home Affordability Report by ATTOM, median-priced single-family homes and condos were less affordable in the fourth quarter of 2022 compared to historical averages in 99% of counties in the US. Moreover, major home-ownership costs now eat up 32% of the average national wage, the highest percentage in fifteen years.

With high interest rates, soaring property values, and inflation forcing the average home buyer out of the market, many real estate investors today have pivoted their investment strategy to focus on single family rentals. The problem is their rehab budget hasn’t pivoted. Many flippers are using the same approach to rehab rentals as they would a flip—to the detriment of their ROI.

Here are some things to consider when budgeting to flip vs. hold.

Rehabbing Fix and Flips vs. Rehabbing Rentals

Every budgetary concern with your flip needs to align with your exit strategy. It’s not simply about rehabbing too much or too little (although that’s part of it); It’s about choosing upgrades that align with your ultimate goal, to flip or hold. Buyers and renters evaluate and use your property differently, so every decision you make—from which rooms to prioritize, to landscaping, appliances, and finishes—needs to take their perspectives into account.

Topics: House Flipping Market Insights, Housing Market Trends

Should you invest in SFR rental properties as interest rates continue to rise?

Rising interest rates and inflation shouldn’t deter you from acquiring long-term rental properties.

In the current market, it can be difficult to determine whether now is the right time to acquire long-term rental properties. Interest rates are still on the rise. According to Bank Rate, the current average rate for a 30-year fixed mortgage is 7.04%, up 12 basis points since September 30, 2022. While inflation appears to be leveling out on some fronts, the buying power of average American families cannot withstand the high cost of money today. This is forcing many Americans to step back and assess the feasibility of buying a home right now.

So, why is it still the right time for the SFR investor to acquire long-term single-family rental properties?

Topics: Investment Property Strategies, Single family rentals

UNLOCKING THE VALUE OF SFR INVESTMENTS

When it comes to investing in single-family real estate (SFR), the best investors are focused, disciplined and strategic. In this article, we’ll explore the merits of two different investment strategies:

- Strategy 1: Fix and Flip (buy, rehab, sell)

- Strategy 2. Fix and Hold (buy, rehab, rent)

On the surface, these investment strategies seem quite simple, almost colloquial to the conversations held at almost every cocktail party or backyard BBQ. Who doesn’t have a friend or family member who told them the story of a house they bought low, sold high, and took the profit to the bank?

By that same token, with the maturity of the SFR asset class over the past decade, who hasn’t heard of the BRRR method—the Rich-Dad-Poor-Dad approach to wealth creation via real estate? Or, knows someone in their circle with a small portfolio of rental houses that provides passive income on the side. The investment in housing as a side hustle or full-time profession seems almost as old as the American Dream of home ownership.

But investing in single-family real estate is not as easy as the newest HGTV show would have you believe. As stated earlier, it requires focus, discipline, and strategy. And the best SFR investors combine the art of the flip with the science of the rental as they walk toward the finish line of wealth creation. If all we have is time and money, let’s explore how we can best utilize both for ultimate success in this game, otherwise known as single-family rental investments.

Topics: Single family rentals

4 Benefits of Having Single-Family Rental Properties in Your Portfolio

Demand for affordable single-family homes is (still) astronomical! If you're a seasoned rehab professional, you know that between sky-high prices and bidding wars, getting your hands on an affordable rehab has been challenging. The good news is that once you get a property under contract, your margins for profit are strong – short term and long term. But, given market conditions, now may be the right time to go long on single-family rental properties to build wealth over time. With interest rates rising, the cost of a mortgage may force prospective buyers to keep renting. And given the stark reality of inflationary pressures in this market, investors can use single-family real estate investment to hedge inflation while building wealth over time.

Topics: Single family rentals

Using the BRRRR Method? Here’s what to do before interest rates rise.

After years of low interest rates, it seems 2022 is the year we’ll see them on the rise. With the Federal Reserve planning to embark on a series of interest-rate hikes this year beginning in March, real estate investors are preparing for these predictions to potentially become reality.

Fortunately, smart investors work from a strategic point of view, and many apply the BRRRR model, which helps in situations like these. To refresh, the BRRRR (Buy, Rehab, Rent, Refinance, Repeat) Method is a real estate investment strategy that involves buying and rehabbing a property, renting it out, and refinancing the leased up rental property over a 30-year term at a fixed rate of interest. This Method provides an opportunity for passive income and a diverse rental portfolio. If BRRRR Method is one of your investment strategies, now is the time to lock in for the long-term.

Topics: Investment Property Strategies

2022 Goal Setting for Your Investment Property Strategies (Part 2)

Welcome back to the second installment of our goal-setting series. If you missed the first installment on SMART goals, be sure to check out Part 1 and begin crafting your goals. Remember, these aren’t resolutions but actionable, achievable goals to help you grow your business. Journaling has a place within that story, and we’re here to help you get started.

JOURNALING to Success

Journaling allows you to take inventory of the past and present and forge a new path for the future. It’s a simple way to get all your thoughts onto the page, and it can help you sort through your priorities. This is a great exercise to help you refine your SMART goals or help you identify what you want to prioritize before you document them. There are no right or wrong answers in journaling; it’s all about getting your thoughts out of your head and onto paper.

Topics: Investment Property Strategies

2022 Goal Setting for Your Investment Property Strategies (Part 1)

Whether you're beginning this new year with goals to start investing in single-family real estate or you’re a seasoned investor who wants to continue expanding your single-family rental portfolio, it's essential to set actionable goals, measure progress, and seek the right guidance along the way.

Why Goals Matter

Goals are very different from New Year's resolutions. While resolutions may be well-intentioned, they are often thrown together without a plan or willingness to sacrifice what’s required for success. Statistic Brain analyzed New Year's resolutions and found that just 8% of people achieve their New Year's resolutions while a whopping 92% fail completely.

Goals, on the other hand, are usually more well-thought-out, and come with action items attached to them. Those action items help frame the decisions and direct the resources applied to accomplishing the goal. They are the milestones to the roadmap which leads to the accomplished goal!

Topics: Investment Property Strategies

Pros and Cons of Vacation Rentals as an Investment Strategy

With 450 million travelers worldwide choosing vacation rentals over hotels in 2020, it’s no wonder why this investment strategy seems so appealing to investors. As the market continues to quickly grow with the prospect of profit (and a few other perks), there are still some considerations to weigh.

Topics: Rental Property Investment, House Flipping Market Insights

2 Big Questions You’re Probably Asking About Whether to Start (Or Keep) Flipping Houses

Whether you were flipping houses long before Chip and Johanna Gaines had a television show or you’re just now considering dipping your toe into the industry – this market is sure to leave you wondering if now is the time to start (or continue) your fix-and-flip journey. Together, we’ll be looking at the opportunity for profit and the obstacles that currently stand in the way.

1. Is the current market conducive to making a profit?

Home prices are still on the rise. The nationwide median listing price for active listings in September 2021 was $380,000, up 8.6 percent from the previous year and up 20.6% compared to 2019. The S&P CoreLogic Case-Schiller Index published the Home Price NSA Index on September 28, 2021, revealing home prices had soared 19.7% in the last 12 months. With affordable housing inventory still low and buyers (or renters) incredibly hungry for a place to call their own, sellers are being showered with offers that are much higher than list price. No one know when the market will flatten out or turn – that’s why it is so important to never forget that there are still other market factors to take into consideration when assessing an opportunity.

Topics: House Flipping Market Insights, Housing Market Trends

How to Foolproof your Fix-and-Flip: Consider Market Climate and Start Smart Investing

Now that we’re less than half a year away from 2022, what do we know so far about 2021? In the last year alone, median values of single-family homes and condos rose more than 10% nationally. This rising surge of new house hunters and a super tight supply of housing inventory was also impacted by an ongoing pandemic. With mortgage rates remarkably low, home buying became an attractive option for many Americans seeking more space, a second home, or a work-from-home office with a better view.

SLIGHT DIP OR REAL DOWNTURN?

Now, halfway into the 10th year in this housing boom, many home investors wonder: will real estate markets flatline or drop? How long will these high prices last? While we can’t see into the future, we have some new data about how 2021 compares so far to prior years, both before and since the housing boom. According to a report from ATTOM, fix-and-flip real estate investments have fallen to the lowest level since 2000. In the first quarter of 2021, the same report cites only one in 37 transactions, or only 2.7% of home sales, were flips. Compare that figure to where we were in the first quarter of 2020: down from 7.5%, or one in 13 sales were categorized as fix-and-flips.

Topics: Fix-and-Flip Financing Tips, House Flipping Market Insights, Housing Market Trends

Home Improvements That Add Value to Your Investment Property

The secret to successful real estate flipping is knowing which improvements attract buyers and enhance the value of the home.

Here are some of the win-win improvements that make buyers and investors both happy.

1. Minimize Costs By Choosing Wisely

The bones of the home, i.e. the basic framework and layout, determine the size of the rehab budget. Jonathan Faccone, Founder, Halo Homebuyers LLC, has this sage advice for flippers: “When choosing a property, look for houses that can be improved without being reconfigured.” That’s particularly true if you want a house with an open concept, or if you envision adding value by adding a bedroom or bath.

Simply put: Painting walls is cheap. Moving walls is another story. If the old adage “you make your money on the buy” is true, then finding a floorplan that works as-is yet needs some love and attention is critical.

2. Cost-Efficient Kitchen Remodeling

A nice, remodeled kitchen is a huge draw for potential buyers. One caveat: It’s easy to go overboard. If you gut an entire kitchen, a mid-range remodel can easily run up to $60,000 — and net you only a fraction of that when the time comes to sell.

It pays to make your kitchen shine when you do it cost effectively:

- Sand and paint cabinets instead of replacing them.

- If paint isn’t enough, try replacing the doors instead of demoing the cabinets

- Instead of a $4,000 stainless fridge, find a tasteful one on sale for $1,000.

Remember: Your hard money loan is generally limited up to 75% of a home’s after-repair value. Choose the remodel projects wisely.

Topics: How to Fix & Flip, House Flipping

A large segment of today’s housing market is fueled by real estate investors seeking to turn a fixer upper into a nice, tidy profit. If you manage to avoid the common rehab pitfalls, you can turn a profit too! But know, mistakes are not made by properties. Mistakes, most often, are made by novice investors and the assumptions they employ on their way to becoming a seasoned investor.

The good news is that the most common mistakes investors make are entirely preventable…if you do these seven things:

1. Underestimating The Project Scope

Underestimating the time, hard costs and the amount of work involved is one of the surest ways to drain the profitability of your flip. You estimate four months of work – it takes six. You estimate for some new shingles – you need a new roof. You estimate your property will sell in four weeks – it sits unsold for three months. In short, each inaccurate estimate makes a direct impact on your bottom line.

2. Underestimating Or Ignoring The Non-Material Costs

Drywall, flooring, windows and landscaping aren’t the only costs that will go into your flip. To turn a profit, you will need to anticipate all the other “soft” costs you’ll incur including: appraisals, closing costs, building permits, inspection fees, realtor costs, property taxes and utilities, as well as interest from the real estate investment loan.

It’s easy to fall into the trap of thinking: “those will be covered when I sell”. But that’s just another way of saying: “it’ll come out of my profits.” Wise investors anticipate those costs up front and build them into their overall budget.

Topics: How to Fix & Flip

How to Find & Keep Good Contractors for House Flipping

Your contractor can have a profound impact on almost every aspect of your real estate flip: deadlines, quality of work, budget, and return on investment. And whether the overall experience will be energizing or draining can also depend on whom you hire.

So, if you’re funding a flip, or using a hard money lender, it’s important to keep your flip on schedule and on budget. We all know that time is money. But unfortunately, not all contractors understand or care. Follow these steps and you’ll be able to find good contractors and build lasting relationships with the ones who come through for you.

Topics: How to Fix & Flip, House Flipping

3 Ways to Get Fix-and-Flip Funding

Flipping a house requires money – lots of money. Beyond the purchase price, single-family investors must come out of pocket for legal fees, appraisal fees, title costs, closing costs, home inspections, rehab costs and disposition costs. In a Seller’s market, these costs have a tendency to go the way of home appreciation…up, up, up and away. Given the median purchase price for existing homes in June 2020 of $295,300, these numbers add up fast especially when you are doing more than one flip investment at a time.

Whether you are flipping one, two, or dozens of houses per year: maintaining adequate cash reserves is critical to keeping your operation up-and-running, so that you can realize the back end profits associated with your investment. As they say…cash is king!

That is why so many single-family investors look for a financing partner to fund their fix-and-flip investment properties. Having more cash on hand gives you, the investor, flexibility in a dynamic market whether that means more cash to realize an unexpected opportunity, more cash to negotiate a better deal with a faster close or more cash to give you peace of mind through the investment cycle. Knowing which available financing options will give you the most flexibility as an investor is the key.

Urban Revival Spurs Rental Property Investment Opportunities

The pandemic has changed our lives and the economy in major ways. For many Americans, it has meant making the switch from working at the office to working from home. And it looks like working from home will continue permanently for many workers, even though some offices have reopened. With the flexibility of working from home, many Americans have opted to change where they call home. You may even be reading this from the comfort of your own home or local coffee shop!

With this new flexibility, some Americans have opted for a new view from their home office window. They are heading for both rural and suburban areas. We’ve witnessed younger households swap city life for the suburbs, while elderly Americans have hurried the decision to relocate to their retirement destination. Others still, have found refuge in country living. So, what’s left to buy, rent, fix, or flip?

To help you on your journey from rehab to rental, download the free Investment Rental Property Neighborhood Checklist.

How Can Single-Family Rental Property Investors Thrive in the Current Market?

All this has meant a hefty surge in demand for suburban single-family homes, retirement locales, vacation homes and investment properties. And while prices of homes in those markets have skyrocketed, both seasoned and first-time rental property and/or fix-and-flip home investors would be wise not to overlook other options with big potential. The flip side of this current real estate market is that with home prices spiking, little inventory, and high construction costs, an urban buy-to-rent property might be your next best investment opportunity.

Even as the talk is still churning about the swelling suburbs, it’s time to take a second look at urban areas. Urban areas have shown a growing increase in both revitalization and investment. Recent real estate market reports also indicate that this urban renewal and resurgence began in the spring and should swell well into summer.

What conditions have created this opportunity for the buy-to-rent investment? There are two factors at play: First, an increasing number of young and would-be first-time home buyers are being priced out of the suburban markets where they find themselves looking for a home. Second, many of the most urban areas have been negatively impacted by this suburban “flight to quality." These two factors could create some urban buying opportunities for the single-family rental investor as the undertow brings the urban dweller back to the city in search of a rental home.

The opportunity for buy-to-rent is here. And whether you are new or a seasoned investor, you won’t want to go into new territory without the right partner. That’s where Residential Capital Partners comes in. We can help you decide if a buy-to-rent investment is right for you.

Topics: Rental Property Investment, House Flipping Market Insights, Single family rentals

Flip vs Flop: How To Sell in a Seller's Market

Your inbox: it’s overflowing. Your desk: it’s piled high. Your mind: it’s scattered, to say the least.

A seller’s market can be a godsend when you’ve just rehabbed a promising fix-and-flip property. But when a seller’s market brings you a high volume of offers, things can get complicated fast. Overwhelmed by your good luck, you may be tempted to simply select the highest offer from the stack.

Don’t. Competition breeds excellence. Use the forces at play in the market to your advantage. Borrowers may lie to you. Markets never will.

Follow these negotiation best practices:

1. Highest and Best Offer

If you are staring at a stack of offers on your rehabbed property, then you have done something right. Now, take your game to the next level. Study the offers that have come in comparing price, closing timeframe, conditions to close, etc., and use the best terms of each offer to outline what would be your perfect offer from the perfect buyer. Pick the 3 to 5 of the strongest buyers that:

- Have the best price and terms.

- Have the most experience.

- Have the strongest proof of funds letter or balance sheet presentation.

Call these buyers and tell them they have been hand selected out of many to sharpen their initial offer into a Highest and Best Offer. Tell them they have until 5:00 PM to get their final offer to you. Tell them you will call them by 6:00 PM to inform them if they won or lost. If they ask, have your “perfect offer” list by your side to give them a hint of where they need to improve. And then, go enjoy your day until the clock strikes 5:00 PM.

Topics: Fix-and-Flip Financing Tips, House Flipping Market Insights, Housing Market Trends

Defer Taxes—Not Profits—With a 1031 Exchange

The purpose of flipping houses — or any property — is to realize a profit. Period. From the minute you secure a property with a hard money loan, your focus is turning your property into a tidy profit that you can take to the bank.

Novice flippers normally have their eyes on this prize. They have worked hard to find the right property. They’ve successfully rehabbed and sold a property or two. They’ve developed relationships in the business from sound contractors to hard money lenders, both of whom can move swiftly at their direction to help them realize their goal – profits and more of them.

But once a novice flipper begins moving up the scale of their craft, their eyes naturally drift to more sophisticated ways to realize and protect their profits as they wield their trade. One of these handy tools of sophistication is the 1031 Exchange.

What Is a Section 1031 Exchange?

Section 1031 is an IRS code that allows you to defer paying capital gains on an investment property if you do a “like-kind” exchange of one property for another.

For example, let’s say you buy a property for $100,000, improve it, and the value rises to $200,000. If you simply sell, you’ll be taxed on your gain at your ordinary income level. But if you trade the property for another property of like value, you can defer your taxes until you sell the exchanged property.

The Rehab to Rental Strategy

The novice turned proficient or expert rehab professional can take the opportunity to turn the 1031 Exchange example above into a powerful wealth building strategy. Upon selling the improved property for $200,000, the rehab professional will immediately begin looking for a property of like-kind or similar value to trade into in order to avoid paying ordinary income tax rates on the gain from sale.

Topics: Fix-and-Flip Financing Tips

5 Ways to Minimize Taxes on Fix and Flips

When you take out a hard money loan, bridge loan or investment property loan to buy a flip, you do it with one goal in mind: to make a profit.

In the process of your rehab, many factors will conspire to eat into your profits. Weather. Time. Unreliable vendors. The list goes on. But, few things eat away as much of your profits as taxes; the more you make, the more you pay.

One of the most effective ways to protect your profit margin is to find legal ways to minimize your taxes. We’ve identified five proven ways to minimize your tax exposure – so you can keep more of the money that you’ve worked so hard for.

1. Maximize Your Deductions

You’re fully aware that drywall, flooring, tile, paint and other hard costs are tax-deductible. So are outside labor costs. But don’t stop there.

Do you have a home office? Do you drive your car to and from the project site? Does that car use gas? Will you be paying any closing costs when you sell? Did you pay interest from a hard money or bridge loan?

Not all of your deductions are related to the renovation. Broaden your scope and see all the costs that go into your flip. Then, make all the deductions you’re entitled to.

One pro tip: Open a dedicated checking account and/or credit card specifically for deductible expenses. At the end of the year, you’ll have one simple report that organizes everything for you.

Topics: Fix-and-Flip Financing Tips, House Flipping Market Insights

Struggling To Differentiate Your Fix-And-Flip Program?

You’re not alone. Nearly one year ago, lenders across the United States froze their fix-and-flip lending programs in response to the COVID-19 pandemic. Today, the market is strong and a resurgence of programs abounds—with one pesky problem: they’re nearly all the same.

Susan Andress is the Business Development Director for Residential Capital Partners’ Correspondent Lending Program. In this role, she’s heard the stories of many lenders facing this conundrum first-hand and helped them make their programs more competitive by using Residential Capital Partners’ platform.

Download the Fix & Flip Correspondent Lending Program Highlights to learn more about our 100% fix-and-flip lending program.

Blazing fast approvals.

The market is hot. Turn-around time is critical. Andress says, “The greatest value I can offer my correspondent is responsiveness and speed in underwriting and closing. We’ve made it a very tight process. Lenders will ask me: ‘How quickly can you close?’ and, I say: ‘As soon as you provide us with a complete file!’”

Residential Capital Partners’ program has an edge thanks to their relationships across the nation. Andress reports, “We have an exhaustive list of appraisers in every market which helps the turn-time on every deal. We also have two dedicated people monitoring the underwriting and approval process.”

Residential Capital Partners has also streamlined the process by providing proof of funds letters to approved borrowers. These letters help borrowers secure a contract from weary sellers trying to pick the right buyer.

ARV Doesn’t Affect Your Bottom Line. It IS Your Bottom Line.

Correctly calculating ARV (After Repair Value) is no cakewalk. The market changes daily – by city, neighborhood, and street. To be a great ARV calculator, you must be equal parts historian, detective, and fortune teller. Perhaps Zen master, too, because the stakes are high: calculating ARV incorrectly can literally cost you hundreds of thousands of dollars.

ARV, by its nature, is a moving target, and most fix-and-flippers never hit a bullseye. Yet, Michael Blatney, Residential Capital Partners’ dedicated Portfolio Underwriting Manager, is one of the industry’s sharpest shooters. Why? Because he’s been flipping houses since before there was a name for it – and more or less discovered the concept of an ARV.

Make your next property walkthrough a breeze.

So, if you want to turn a profit flipping houses in 2021, when the market is tight and inventory is low, keep reading and heed his advice.

The (STILL THRIVING) Opportunity for Rental Investors Today

[UPDATED: Nov 18, 2021]

If you haven’t already invested in suburban rental properties, it’s time to start.

Suburban rental properties are not slowing down – they are gaining momentum. The American family is turning to single-family rental homes like the American settlers headed West! They are not looking for land, but they are looking for space – space for bedrooms, bathrooms, storage, a yard, home offices, etc. They’re also looking for lifestyle as they throw in the towel on bidding wars to buy a place and opt, instead, to rent while keeping that down payment in the bank.

This trend is driving new rent paying tenants to the single-family landlord while also providing the landlords with an opportunity to raise their rents. According to CoreLogic, single-family homes rental cost increased 9.3% in August 2021 nationwide. This represents a 2.2% year-over-year increase since August 2020. Since January 2021, the national median rent has increased by an astounding 16.4%, with the typical rent costing $1,633 per month. That is $169 more than this time last year and almost $200 more than 2019’s numbers.

How can the American family afford these kinds of rental rate increases? For many, the answer lies in a lower cost of living spelled S-U-B-U-R-B-I-A. Post-pandemic teleworking still represents a large part of the workforce’s reality. In September 2021, 13.9% of the American workforce teleworked at some point in the month. Even pre-pandemic, two-thirds of people worldwide work away from the office at least once a week, according to researchers at Zug. And working remotely allows workers to move farther from the office and enjoy a lower cost of living outside city limits.

If you’re looking to take advantage of this opportunity and diversify your portfolio with single-family rental investment properties, here’s everything you should know to get the most out of your rental.

How to Choose a Fix-and-Flip Lender During a Recession

Panic is the enemy to your investment strategy. Choosing the right hard money lender might just be the antidote.

As any neuroscientist can tell you, humans make poor decisions when they panic – and property investors are no exception. Panic literally disengages our pre-frontal cortex – the area of our brains that brings logic and flexibility into decision-making. Under duress, our brains instead rely on the amygdala – the part of your brain that responds to instinct, emotion, and the impulse otherwise known as “fight or flight”. You know, the stuff any seasoned real estate investor will tell you to avoid when making an investment.

Any hard money lender worth their salt will tell you to avoid these very same impulses when a crisis hits while offering sage advice such as “your safest bet is to stay the course” or “maintain objectivity”. So why is it so many lenders haven’t taken their own advice, and either stopped giving out new loans or inflated their interest rates in response to Coronavirus?

Perhaps it’s not so easy for lenders to walk the talk without prior experience lending during a turbulent economy.

Topics: Fix-and-Flip Financing Tips, Fix-and-Flip Lenders, Private Money Lenders

How To Save On House Flipping Renovations During Coronavirus

Investing in real estate during “unprecedented times” is not for the faint of heart. Nevertheless, savvy, seasoned house flippers recognize that this change in the market presents a great opportunity to outbid and outperform the competition — if you keep moving and adhere to your budget.

Consider this your cheat sheet for saving a bit here and there while renovating during Coronavirus. Little differences in your business practices can make a big impact on your bottom line this year.

1. Don’t Stop Flipping or Renovating

The market goes up and the market goes down. It’s easy to remember when times are good, and harder to remember in the face of uncertainty, especially when your TV and social media channels skew to the negative.

But now is actually a great time to invest, provided you have an ample safety net. If you don’t already know, Residential Capital Partners formed during the 2008 housing crisis — when other lenders were closing their doors. There is no room for panic in house flipping. Invest when others doubt.

People are still buying houses. By this May, demand for housing surpassed pre-COVID-19 levels. Which means you should keep flipping with as much cash as you can muster so you can keep turning a profit. Never let a good crisis go to waste!

2. Choose the Right Property

Buy Properties in Great Locations

Coronavirus may have thrown real estate for a loop, but the golden rule still applies: location, location, location. As always, aim for homes of lesser value in neighborhoods that are seeing an increase in value.

Buy Properties That Need Minimal, High-Return Upgrades

S

ome experienced house flippers pride themselves on snapping up houses that need

a lot

of elbow grease. Forget that strategy for now. Why? You’re on Corona-time. Which means paperwork and coordinating with contractors will take longer. Store hours are affected. Materials may be on backorder. The project will lag on too long for you to get a great return.

What will get you a better return is updating your kitchens and bathrooms. According to US News, low-end kitchen remodeling in the United States starts at just $4,000. The starting cost of a low-end bathroom makeover is $6,000. That’s pennies compared to large overhaul projects, like wood flooring, a second story or other additions to square footage.

Salvage what you can to keep the character of the home – and save yourself some cash. Opt to paint out-of-date cabinetry, instead of installing new cabinets. See if you can keep existing tile, and replace the toilet, sink, and hardware. Our rule of thumb: low to moderate repairs wins every time!

Topics: How to Fix & Flip, COVID-19, House Flipping

Rehab to the Rescue: Flipping An 1800s Townhome in Philadelphia

Scott Gurten and his partner Nick Ferroni have funded five house flips through Residential Capital Partners and counting. Two were house flipping success stories that caught the attention of Philadelphia Magazine.

Their house flip on South 45th street was news-worthy due to Scott and Nick’s masterful renovation. Like many homes in the Northeast, part of the townhome’s charm was its history. Scott and Nick wanted to preserve the home’s character while modernizing key features.

1846 Latona St., Philadelphia, Pa. 19146 | Bright MLS images via BHHS Fox & Roach Realtors

In Scott’s words, “We finance our flips through Residential Capital Partners because they offer 100% financing to keep my up-front costs low. This creates opportunity and flexibility with my cash during the investment period, because I don’t have to put large down payments down.”

With more cash in their pocket, Nick and Scott were able to make updates to the front of the home while preserving the original 1800s woodwork on the façade.

Main entry

Topics: House Flipping Market Insights

Now that you’ve used fix and flip financing to renovate your most recent rental property, it’s time to put it on the market.

The average renter tours nearly three properties over 2.5 months before making a decision, according to Zillow’s 2019 Consumer Housing Trends Report. Don’t let an empty rental property cost you even more money on your investment property loan.

Having a plan to find reliable tenants is as important as securing funding for your investment property. Use these five marketing tactics to catch the attention of high-quality renters, so you can start getting a return on your investment immediately after rehabbing your rental property.

1. Take Professional-Grade Photos.

This is non-negotiable. Why? A listing without photos is too easy to ignore. Plus, listings with high-quality images get 94% more views, according to QuickSprout. Also, intriguing photos could increase the rental price of your fix and flip between 1-7%, according to a Redfin study examining the impact high-quality photos had on house prices.

If you don’t have the time or budget to work with a professional photographer, consider a DIY approach. Smartphone cameras have come a long way — but you need to know how to use it.

3 Ways to Spot Trustworthy Fix and Flip Lenders

Finding a trustworthy fix and flip lender can be the start of a beautiful, mutually beneficial business relationship.

But a misleading lender can lose you time and money. Lenders don’t like to turn away business. So, if your deal isn’t a solid, unwavering “yes,” you may hear, “I’ll see what I can do” or “we’re still working on this.” Sometimes, this templated response comes long after the initially promised deadline. Why? Often, the lender is working behind the scenes, trying to make a deal happen for you — even if it’s in the form of an exception.

Bottom line: Don’t leave your investment property loan pending on empty words. Look for a lender who will give you a quick answer and an honest assessment of your deal.

Before you sign — or pay — anything, look for these three qualities in rehab lenders.

#1. They’re Available.

Questions can arise quickly in this business, and you need answers ASAP. Getting in touch with your lender should be easy. A good lender will give you multiple points of contact, and they’ll answer your questions in a timely manner.

#2. The Terms of the Loan Are Clear.

Having clear, easy-to-understand loan terms is simply good business. A trustworthy lender will outline any fees and loan terms before you get to the closing table. Murky fix and flip loan terms can lead to unrealistic expectations of a deal. A reliable lender will willingly help you understand what you’re signing.

Investing in Rental Property for Beginners

For many real estate investors, rental properties deliver a dream come true: passive income. Done right, your rental property will produce mailbox money. Your tenants pay rent, you provide maintenance here and there and your property appreciates while you enjoy the financial security of a cash-flowing asset. Even more, you can have pride in knowing you put your money to work for you.

But, to do it right, you’re going to need to do your homework and watch out for common flipping mistakes so you don’t fall victim to a bad rental property investment. Here are the 4 most important things to consider when investing in rental properties:

1. Invest in Neighborhoods You Understand

Warren Buffet famously proclaimed, “I only invest in things I understand.” The same rule applies to the single-family rehab and rental business: invest in places you know and understand. You’ll be familiar with details others might overlook, such as the rumored expansion of a large corporation nearby, or the addition of an upscale grocery store around the corner. How walkable is the area? What is the school district like? Is there a college nearby?

For help on your journey from rehab to rental, download this free investment rental property neighborhood checklist

Topics: Fix-and-Flip Financing Tips, Rental Property Investment, Single family rentals

6 Reasons to Finance a House Flip in Winter

Conventional wisdom says that late spring and early summer is the best time to sell a home or an investment property, but real estate investors and hard money lenders alike know that winter poses its own special opportunities, and that the colder months can be an ideal time to make your move.

Aside from the fact that hard money loans or property investment loans are also available in winter, there are other reasons why the winter months could be prime time to finance a house flip.

1. Less Competition From Home Buyers

For most people, winter is a time for family and holidays. Their cash is likely to go to presents and travel. Any major moves, such as the purchase of a new home, are often put on hold.

Because of this, you can approach sellers in the winter months knowing that the market is slower than usual. In the US, the annualized price of the average home can fluctuate 5-7%, depending on the time of year. In active markets like Dallas, the fluctuations have been recorded as high as 12%. And, almost without exception, the point at which prices hit their lowest level occurs during winter months.

2. The Timing From “Fix to Flip” Is Perfect.

Statistically, the best time to sell a house is in May. Houses sold during the first half of May typically sell 18.5 days faster than other months and go for 5.9% more money. On a $200,000 house, that could be a cool $11,200 bump in profits.

If you purchase a property in December, you can shoot for a completion date of May to bring your renovated property to market. It’s as simple as that: Buy during the slow season, and sell during the peak season. That’s a simple yet very effective way to maximize your profits.

Topics: Fix-and-Flip Financing Tips