The terms of fix-and-flip private loans can differ from lender to lender, and sometimes even deal to deal. (Sadly, the bait-and-switch method still lives on in private lending. Luckily, our terms never change.) It’s a frustrating task to try and create an apples-to-apples comparison of loan terms, which is why sometimes investors eschew much of the information about their loans to focus on a single element: interest rate. But interest rates are only one influencing factor in the overall cost and quality of your loan. It’s mission-critical to understand each line item of your terms and know exactly how much you’ll have to bring with you on closing day (ideally… as little as possible!).

The terms of fix-and-flip private loans can differ from lender to lender, and sometimes even deal to deal. (Sadly, the bait-and-switch method still lives on in private lending. Luckily, our terms never change.) It’s a frustrating task to try and create an apples-to-apples comparison of loan terms, which is why sometimes investors eschew much of the information about their loans to focus on a single element: interest rate. But interest rates are only one influencing factor in the overall cost and quality of your loan. It’s mission-critical to understand each line item of your terms and know exactly how much you’ll have to bring with you on closing day (ideally… as little as possible!).

To understand the big picture, let’s unpack the most common terms written into a fix-and-flip private loan, and their impact on your ROI.

Amount Funded

It’s always a good day to get a check in the mail (or transfer to your account) from your rental properties. Your net cash flow is the money you get from your tenants, minus expenses and your loan payment.

Example: You purchase a $120,000 rental home. Tenants pay you $1,200 monthly. If your expenses and loan are $1,100, your net cash flow on a monthly basis is $100. Granted, $1,200 a year isn’t a large chunk of change. It’s more like the cherry on top of the other ways rental properties make you money. Compare it to the dividend of a stock; it’s likely not your primary reason for the investment, but it sure doesn’t hurt.

Related: Learn tips and tricks on calculating ARV from Michael Blatney, Portfolio Underwriting Manager.

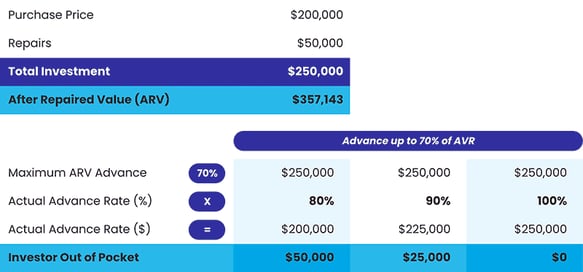

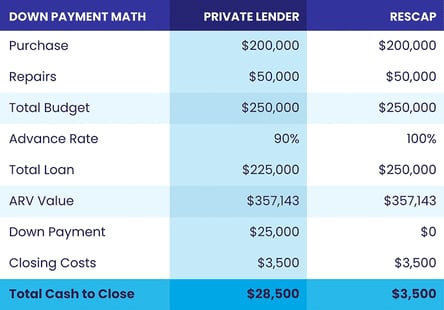

The industry standard in private lending is to loan a percentage of up to 70% of the ARV of the property. For example, most lenders will give you an 80% advance up to 70% of ARV, or a 90% advance up to 70% of ARV. Residential Capital Partners offers an unusually generous 100% advance up to 75% of ARV, providing you with 100% of the money you need to close a property and complete the repairs without coming with a down payment at closing. The math looks like this:

As you can see in the example above, the advance rate percentage makes a big impact on amount of out-of-pocket money required by the investor on each deal. The higher the advance rate, the less money out of pocket.

Why does the amount of out-of-pocket money required by investors matter so much? To answer that, let’s examine the effect of down payments on your deal.

Down Payment

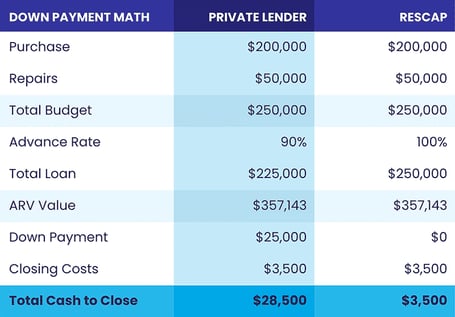

Down payments drag down the cash in your bank account—while also dragging down your ROI. In the math example above, the investor would have to come with 10% to 20% of the $200,000 purchase price at closing. That’s $20,000 to $40,000 down at closing, plus closing costs! Do that three to six times and down payments really add up.

So, why does the down payment matter to most private lenders?

Because they are not planning on holding the loan after they make the loan to you. They are planning to sell the loan to Wall Street. And Wall Street wants you coming with a down payment so that they can promise “the street” that you have skin in the game.

Skin in the game will skin you and your investment returns alive. Let’s look at the math again:

Using a private lender who sells to Wall Street, the investor’s ROI equaled 21%. Not bad. Using Residential Capital Partners, a balance sheet lender who does not sell to Wall Street, the investor’s ROI equaled 38%. That’s nearly twice the return. Don’t drag your cash reserves and returns down with down payments.

Now, as an experienced investor, you might be thinking, “I’ve been successful in this business for a long time. I have plenty of money. Why should I care about down payments?” But if you can make twice the return on the same investment with less money down, you should do it to maximize your return and deal flow.

Watch this to learn about the multiplier effect.

Down with the down.

Interest Rate

Private lenders will use low interest rates as an attempt to win your business. At first blush, a comparatively low interest rate seems like a good deal. However, a low interest rate does not necessarily mean a more profitable deal. The impact of a lower interest rate on a short-term rehab investment is noise in comparison to the impact of the amount funded and down payment.

To illustrate, let’s take this same example from before:

In this example, we used a 7% interest rate for the typical private lender performance schedule and a 10% interest rate for the Residential Capital Partners performance schedule. The investor paid $3,500 more in interest to Residential Capital Partners than to the other private lender. Did profit suffer? No. Did ROI suffer? No, the ROI was twice that of the other private lender. Did the investor have to come with a down payment? No. This is why interest rates are noise for rehab deals—the impact is nominal in comparison to other factors.

Origination Fee

The origination fee of your loan is another example of noise when considered the performance of your deal through the lens of ROI. In the example above, the private lender charged the investor 1.50% points ($3,750) while Residential Capital Partners charged the investor 3.00% points ($7,500) for a total difference of $3,750. That’s $3,750 more in upfront points with Residential Capital Partners.

The origination fee of your loan is another example of noise when considered the performance of your deal through the lens of ROI. In the example above, the private lender charged the investor 1.50% points ($3,750) while Residential Capital Partners charged the investor 3.00% points ($7,500) for a total difference of $3,750. That’s $3,750 more in upfront points with Residential Capital Partners.

This is a drop in the bucket when you consider the other factors affecting ROI:

What was the down payment for the private lender?

Private Lender: $20,000 to $40,000

Residential Capital Partners? $0

What was the ROI with the private lender’s loan?

Private Lender: 21.8%

Residential Capital Partners? 38%

What Terms Can’t Tell You

What Terms Can’t Tell You

Terms can tell you a lot, but they don’t cover the whole story. As Paul Jackson, Residential Capital Partners’ principal is fond of saying, “Terms talk the talk of private lending. Reputations walk the walk of private lending.” When comparing loans, be careful to not let the terms talk you into a lender. A lender’s reputation and operating philosophy will always be more important than the terms.

Here’s why:

Here’s why:

Some private lenders appear to have the best terms and appear to approve any loan. These private lenders view their role as that of a “yes man”, meaning they will, in fact, work to approve any loan that comes in. You will benefit much more if your private lender acts as a wealth manager or wealth advisor, counseling you on how to generate sound profits off sound deals that will generate real wealth for you, the investor.

Control Your Destiny

Don’t make the mistake of fixating on finding the best terms, thinking it will help you control your destiny as an investor. Other factors, like your lender’s reputation, and source of capital can have a profound (and likewise, devastating) impact on your trajectory. For example, if your lender’s funds come from Wall Street, you might just get left in a market swing. On the other hand, if your private lender is a balance sheet lender (like Residential Capital Partners) have a candid conversation with them about the control they have over their lending business. Ask questions. Lots of them.

Learn the key questions to ask your lender by reading What to Know About Your Private Lender.

![]()

Go with a lender with transparent terms-no catch