Whether you're beginning this new year with goals to start investing in single-family real estate or you’re a seasoned investor who wants to continue expanding your single-family rental portfolio, it's essential to set actionable goals, measure progress, and seek the right guidance along the way.

Why Goals Matter

Goals are very different from New Year's resolutions. While resolutions may be well-intentioned, they are often thrown together without a plan or willingness to sacrifice what’s required for success. Statistic Brain analyzed New Year's resolutions and found that just 8% of people achieve their New Year's resolutions while a whopping 92% fail completely.

Goals, on the other hand, are usually more well-thought-out, and come with action items attached to them. Those action items help frame the decisions and direct the resources applied to accomplishing the goal. They are the milestones to the roadmap which leads to the accomplished goal!

Actionable Goal Setting

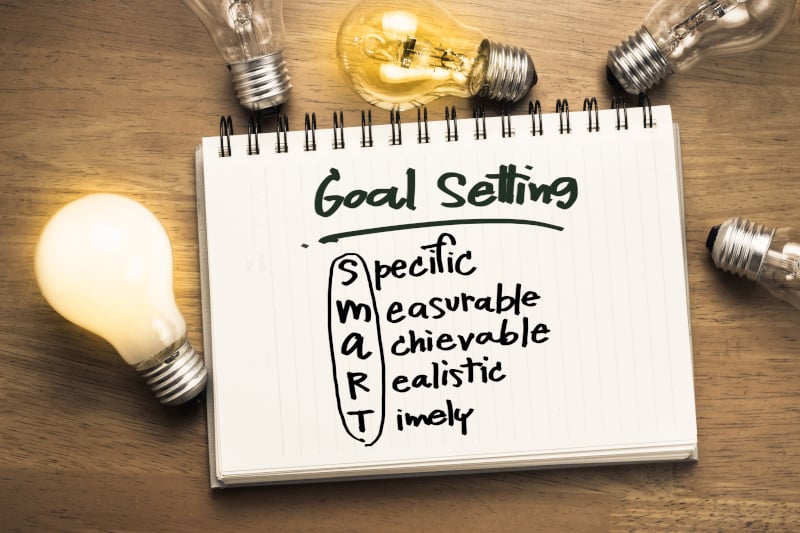

When setting goals, make sure you create specific, measurable milestones that you can track as you work to accomplish your goal.

The Australian Investors Association recommends using the SMART format when setting investment goals:

- Specific – make each goal clear and specific

- Measurable – frame each goal so that you know when you have achieved it

- Achievable – you need to take practical action to achieve a goal

- Relevant – determine whether your goals relate to your life and are realistic

- Time-based – assign a timeframe to each goal so you can track progress

This method is a common rule of thumb intended to keep you on track to achieving your goals.

Specific. In order to be successful, you need to be specific. A specific goal addresses questions like.

- What am I trying to accomplish?

- How will I get there?

- What do I need to achieve this?

Example: To build a real estate portfolio, I need to stop selling every fix-and-flip property and secure long-term financing on every 5th property I purchase. To do this, I will need a relationship with a lender that will not only fund my flips, but also finance properties for me over a 30-year period.

Measurable. Create a marker for success to let you know whether you're on the right path or if you need to adjust.

Example: Right now, I am fixing and flipping 5 homes per month. If I am to accomplish my goal of building a real estate portfolio by holding every 5th property (1 per month), then I will have accomplished my goal if I own 12 single-family rental properties at the end of the year. At the end of each quarter, I will look at my success or failure and continue or adjust.

Achievable. This is where honesty and practicality meet. Is this an attainable goal? It's fantastic to create audacious goals that can and will stretch you but creating an impossible goal is failure from the start.

Example: If you are just jumping into single-family real estate investing, you might think: “I am going to buy one property per month!” While that doesn’t seem like too big of a stretch, there is a ramp-up time for any new business endeavor. A better goal might be: “I am going to set out to buy one property in the 1st quarter of this year!” From there, you can set your next achievable goal while keeping the ultimate goal of one property per month in the back of your mind.

Relevant. This is where you ask yourself why?

Example: Why do I want to build a rental portfolio made up of every 5th property that I purchase each month? Well, I have been making good money in my fix-and-flip business, but every year I have to restart the same investment cycle (aka: the grind). I want to keep investing in single-family real estate because I love it, but I want to build wealth and passive income while maintaining my fix-and-flip business. I’m not getting any younger and in 20 years, I would like to have a rental portfolio that could support my lifestyle should I choose to retire or work less.

Time-Based. What is the time frame by which you want to accomplish this? If you leave it open-ended, you could be holding onto this goal for years. Give yourself a deadline.

Example: This week, I am going to call a lender to discuss long-term rental financing and learn what will be required of me as I look to secure long-term financing on my next single-family real estate investment. I will apply for credit this week and submit the requisite financing documents to the lender so that I am approved and ready when I find my next investment property.

Having trouble setting (or meeting) your SMART goals?

Schedule a 30-minute virtual meeting with one of our experienced account representatives.