The Coffee Shop Conversations That Spark Real Estate Investing Wins

Topics: Single family rentals, House Flipping, Rental Property Tips, Fix-and-Flip tips, Networking

The Real Estate Investor’s Guide to Seasonal Property Maintenance

Here’s a quick guide we've put together to emphasize some of the most important seasonal maintenance tasks you should consider as a fix and flip or long-term rental property investor.

Topics: Rental Property Investment, Single family rentals, House Flipping, Rental Property Tips, Fix-and-Flip tips

Tenant Red Flags: What Experienced Real Estate Investors Look For Before Signing a Lease

Here are some key red flags to keep in mind before signing that lease and turning over your property.

Topics: Rental Property Investment, Single family rentals, House Flipping

5 Essential Questions to Ask Your Private Lender

Topics: How to Fix & Flip, House Flipping Market Insights, Property Investment Strategies, Single family rentals, House Flipping

Sell Your Fix and Flip Faster: The Power of Staging and Photography

Here’s why staging and photography should be part of your flipping playbook—and how to use them to your advantage.

Topics: How to Fix & Flip, House Flipping Market Insights, Property Investment Strategies, House Flipping

Smart Renovations to Maximize ROI in 2025

Topics: How to Fix & Flip, House Flipping Market Insights, Property Investment Strategies, Single family rentals, House Flipping

Building a Rental Empire: Strategies for Scaling Your Rental Property Portfolio

When you’ve successfully launched your first rental investment—maybe you've renovated the place and stayed within budget, tenants are secured, and you have consistent cash flow coming in—it can feel like you’ve cracked the code. Passive income, long-term equity growth, and tax advantages are just a few of the reasons smart investors look to investing in rental properties in the first place. But the real momentum starts when you go from one or two properties to building a full-scale portfolio.

So, how do you scale strategically and what should you keep in mind as you grow? We've outlined a few smart strategies to help you build your rental empire, one property at a time.

Topics: Fix-and-Flip Financing Tips, House Flipping Market Insights, Single family rentals

Budgeting Beyond the Purchase Price—Understanding the Less Obvious Costs of Your Fix and Flip

If you're looking to maximize your returns, here’s a comprehensive look at the real cost of a fix and flip, with key expenses you need to account for before signing on the dotted line.

Topics: Fix-and-Flip Financing Tips, Property Investment Strategies, Budgeting Tips

Bridge Rental Loans vs. Long-Term Rental Loans: Understanding the Differences

Topics: Property Investment Strategies, Single family rentals, Loans

Turning High Rates into High Opportunities: Smart Moves for Real Estate Investors

If the Federal Reserve’s rate hikes have your stomach in knots, you’re not alone. America is grappling with an affordable housing crisis. Demand remains high, but rising interest rates have created a gridlock in supply. It’s tempting to hunker down and wait for the storm to pass during such uncertain times. While this defensive approach is common, history teaches us that challenges often mask opportunities.

Topics: Fix-and-Flip Financing Tips, House Flipping Market Insights

Advice for Real Estate Investors Heading Into 2025

As the new year approaches, the real estate market continues to evolve, presenting new challenges and opportunities for investors. Whether you're focusing on fix-and-flip projects or building a portfolio of long-term rental properties, staying informed and agile is key. Here are some practical tips to help you thrive in the year ahead.

Topics: Fix-and-Flip Financing Tips, House Flipping Market Insights

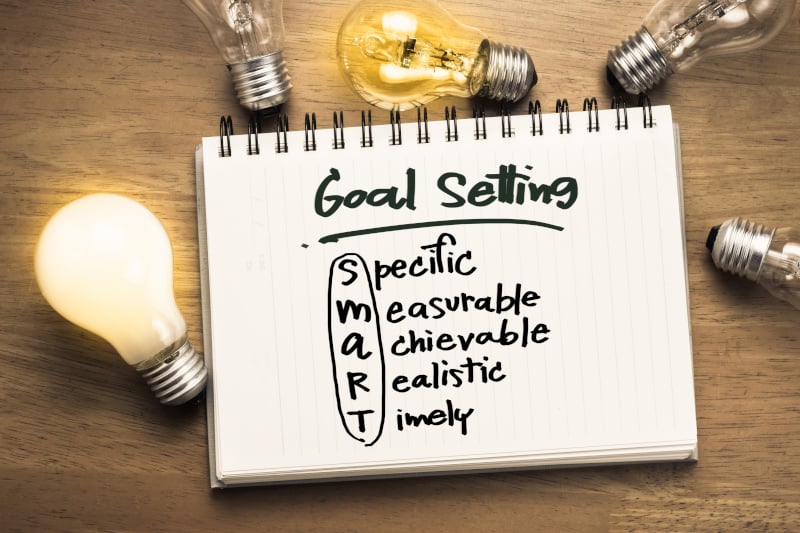

Goal Setting Strategies to Invest Smarter in the New Year

As the new year approaches, it's the perfect time to set fresh goals and shape your investment strategies for success in 2025. Real estate investment properties offer exceptional opportunities to build wealth, but maximizing returns requires a thoughtful plan. Here are some key steps to help guide your investment property strategies and make 2025 your most profitable year yet.

Topics: Fix-and-Flip Financing Tips, House Flipping Market Insights, Single family rentals