Bridge Rental Loans vs. Long-Term Rental Loans: Understanding the Differences

Topics: Property Investment Strategies, Single family rentals, Loans

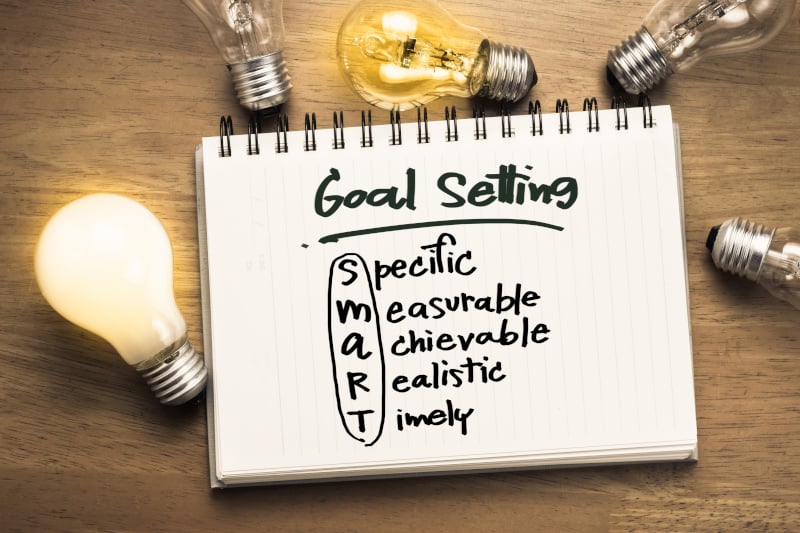

Goal Setting Strategies to Invest Smarter in the New Year

As the new year approaches, it's the perfect time to set fresh goals and shape your investment strategies for success in 2025. Real estate investment properties offer exceptional opportunities to build wealth, but maximizing returns requires a thoughtful plan. Here are some key steps to help guide your investment property strategies and make 2025 your most profitable year yet.

Topics: Fix-and-Flip Financing Tips, House Flipping Market Insights, Single family rentals

4 Key Considerations for Investing in Rental Property

Rental properties continue to be a popular investment option, offering the potential for steady passive income and long-term financial security. However, success in this area requires careful planning, knowledge of the market, and a clear investment strategy. Whether you’re a seasoned investor or new to real estate, we've outlined four of the most important things to consider when investing in rental properties today.

Topics: Fix-and-Flip Financing Tips, Rental Property Investment, Single family rentals

Why Winter May Be the Best Time to Finance Your Fix-And-Flip

As you trade those shorts and tanks for sweaters and fireside blankets, try not to get too cozy—motivated real estate investors know that this chilly season can offer a hotbed of opportunities. From less competition to potential tax deferment, we're outlining some compelling reasons why winter might just be the perfect time to get your next project underway.

Topics: Fix-and-Flip Financing Tips, House Flipping Market Insights, Single family rentals

Hot Suburban Markets for Rental Properties in 2024

As we move further into 2024, the real estate market continues to evolve, with suburban areas emerging as prime spots for rental property investments. The pandemic’s lasting impact on work-life dynamics has driven many families and professionals to seek more space and a better quality of life outside urban centers. For real estate investors, this shift presents a golden opportunity. Let’s explore some of the hottest suburban markets for rental properties in 2024.

Topics: Rental Property Investment, House Flipping Market Insights, Property Investment Strategies, Single family rentals, real estate investing

Should you invest in SFR rental properties as interest rates continue to rise?

Rising interest rates and inflation shouldn’t deter you from acquiring long-term rental properties.

In the current market, it can be difficult to determine whether now is the right time to acquire long-term rental properties. Interest rates are still on the rise. According to Bank Rate, the current average rate for a 30-year fixed mortgage is 7.04%, up 12 basis points since September 30, 2022. While inflation appears to be leveling out on some fronts, the buying power of average American families cannot withstand the high cost of money today. This is forcing many Americans to step back and assess the feasibility of buying a home right now.

So, why is it still the right time for the SFR investor to acquire long-term single-family rental properties?

Topics: Investment Property Strategies, Single family rentals

UNLOCKING THE VALUE OF SFR INVESTMENTS

When it comes to investing in single-family real estate (SFR), the best investors are focused, disciplined and strategic. In this article, we’ll explore the merits of two different investment strategies:

- Strategy 1: Fix and Flip (buy, rehab, sell)

- Strategy 2. Fix and Hold (buy, rehab, rent)

On the surface, these investment strategies seem quite simple, almost colloquial to the conversations held at almost every cocktail party or backyard BBQ. Who doesn’t have a friend or family member who told them the story of a house they bought low, sold high, and took the profit to the bank?

By that same token, with the maturity of the SFR asset class over the past decade, who hasn’t heard of the BRRR method—the Rich-Dad-Poor-Dad approach to wealth creation via real estate? Or, knows someone in their circle with a small portfolio of rental houses that provides passive income on the side. The investment in housing as a side hustle or full-time profession seems almost as old as the American Dream of home ownership.

But investing in single-family real estate is not as easy as the newest HGTV show would have you believe. As stated earlier, it requires focus, discipline, and strategy. And the best SFR investors combine the art of the flip with the science of the rental as they walk toward the finish line of wealth creation. If all we have is time and money, let’s explore how we can best utilize both for ultimate success in this game, otherwise known as single-family rental investments.

Topics: Single family rentals

4 Benefits of Having Single-Family Rental Properties in Your Portfolio

Demand for affordable single-family homes is (still) astronomical! If you're a seasoned rehab professional, you know that between sky-high prices and bidding wars, getting your hands on an affordable rehab has been challenging. The good news is that once you get a property under contract, your margins for profit are strong – short term and long term. But, given market conditions, now may be the right time to go long on single-family rental properties to build wealth over time. With interest rates rising, the cost of a mortgage may force prospective buyers to keep renting. And given the stark reality of inflationary pressures in this market, investors can use single-family real estate investment to hedge inflation while building wealth over time.

Topics: Single family rentals

Urban Revival Spurs Rental Property Investment Opportunities

The pandemic has changed our lives and the economy in major ways. For many Americans, it has meant making the switch from working at the office to working from home. And it looks like working from home will continue permanently for many workers, even though some offices have reopened. With the flexibility of working from home, many Americans have opted to change where they call home. You may even be reading this from the comfort of your own home or local coffee shop!

With this new flexibility, some Americans have opted for a new view from their home office window. They are heading for both rural and suburban areas. We’ve witnessed younger households swap city life for the suburbs, while elderly Americans have hurried the decision to relocate to their retirement destination. Others still, have found refuge in country living. So, what’s left to buy, rent, fix, or flip?

To help you on your journey from rehab to rental, download the free Investment Rental Property Neighborhood Checklist.

How Can Single-Family Rental Property Investors Thrive in the Current Market?

All this has meant a hefty surge in demand for suburban single-family homes, retirement locales, vacation homes and investment properties. And while prices of homes in those markets have skyrocketed, both seasoned and first-time rental property and/or fix-and-flip home investors would be wise not to overlook other options with big potential. The flip side of this current real estate market is that with home prices spiking, little inventory, and high construction costs, an urban buy-to-rent property might be your next best investment opportunity.

Even as the talk is still churning about the swelling suburbs, it’s time to take a second look at urban areas. Urban areas have shown a growing increase in both revitalization and investment. Recent real estate market reports also indicate that this urban renewal and resurgence began in the spring and should swell well into summer.

What conditions have created this opportunity for the buy-to-rent investment? There are two factors at play: First, an increasing number of young and would-be first-time home buyers are being priced out of the suburban markets where they find themselves looking for a home. Second, many of the most urban areas have been negatively impacted by this suburban “flight to quality." These two factors could create some urban buying opportunities for the single-family rental investor as the undertow brings the urban dweller back to the city in search of a rental home.

The opportunity for buy-to-rent is here. And whether you are new or a seasoned investor, you won’t want to go into new territory without the right partner. That’s where Residential Capital Partners comes in. We can help you decide if a buy-to-rent investment is right for you.

Topics: Rental Property Investment, House Flipping Market Insights, Single family rentals

The (STILL THRIVING) Opportunity for Rental Investors Today

[UPDATED: Nov 18, 2021]

If you haven’t already invested in suburban rental properties, it’s time to start.

Suburban rental properties are not slowing down – they are gaining momentum. The American family is turning to single-family rental homes like the American settlers headed West! They are not looking for land, but they are looking for space – space for bedrooms, bathrooms, storage, a yard, home offices, etc. They’re also looking for lifestyle as they throw in the towel on bidding wars to buy a place and opt, instead, to rent while keeping that down payment in the bank.

This trend is driving new rent paying tenants to the single-family landlord while also providing the landlords with an opportunity to raise their rents. According to CoreLogic, single-family homes rental cost increased 9.3% in August 2021 nationwide. This represents a 2.2% year-over-year increase since August 2020. Since January 2021, the national median rent has increased by an astounding 16.4%, with the typical rent costing $1,633 per month. That is $169 more than this time last year and almost $200 more than 2019’s numbers.

How can the American family afford these kinds of rental rate increases? For many, the answer lies in a lower cost of living spelled S-U-B-U-R-B-I-A. Post-pandemic teleworking still represents a large part of the workforce’s reality. In September 2021, 13.9% of the American workforce teleworked at some point in the month. Even pre-pandemic, two-thirds of people worldwide work away from the office at least once a week, according to researchers at Zug. And working remotely allows workers to move farther from the office and enjoy a lower cost of living outside city limits.

If you’re looking to take advantage of this opportunity and diversify your portfolio with single-family rental investment properties, here’s everything you should know to get the most out of your rental.

Investing in Rental Property for Beginners

For many real estate investors, rental properties deliver a dream come true: passive income. Done right, your rental property will produce mailbox money. Your tenants pay rent, you provide maintenance here and there and your property appreciates while you enjoy the financial security of a cash-flowing asset. Even more, you can have pride in knowing you put your money to work for you.

But, to do it right, you’re going to need to do your homework and watch out for common flipping mistakes so you don’t fall victim to a bad rental property investment. Here are the 4 most important things to consider when investing in rental properties:

1. Invest in Neighborhoods You Understand

Warren Buffet famously proclaimed, “I only invest in things I understand.” The same rule applies to the single-family rehab and rental business: invest in places you know and understand. You’ll be familiar with details others might overlook, such as the rumored expansion of a large corporation nearby, or the addition of an upscale grocery store around the corner. How walkable is the area? What is the school district like? Is there a college nearby?

For help on your journey from rehab to rental, download this free investment rental property neighborhood checklist

Topics: Fix-and-Flip Financing Tips, Rental Property Investment, Single family rentals